Department Mission and Guiding Principles

We provide the highest level of police services in partnership with the community to enhance the quality of life. We provide public safety and maintain order, enforce the laws of North Carolina, uphold the United States Constitution, and support National security. We adhere to the guiding principles of integrity, fairness, respect, and professionalism.

Guiding Principles:

- Integrity – honesty, compassion, trust, and accountability. Police Officers have the courage to do what is morally, ethically, and legally right regardless of risk.

- Fairness – The Police Department will treat everyone impartially without favoritism or bias.

- Respect – The Police Department will treat everyone with dignity and courtesy without prejudice.

- Professionalism – The Police Department will deliver quality services through cooperation, open communication, and a commitment to continuous improvement.

The Asheville Police Department is a CALEA-accredited agency.

If you have an emergency, call 9-1-1.

If you have a question, issue, or don’t know who to contact you can reach the Asheville Police Department Communications Center 24/7/365 on the non-emergency line at 828-252-1110.

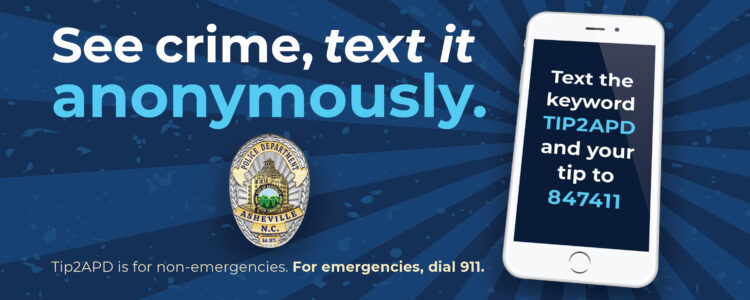

How to submit a tip to the police.